The insurtech ecosystem not only faces intense competition but also presents vast opportunities for innovative Marketing Ideas. As of 2022 data, the United States alone was home to an astonishing 5,929 insurance companies, contributing to a remarkable $1.4 trillion in premiums.

To emerge triumphant amidst this fast-paced and densely populated market, insurance companies must distinguish themselves from competitors by embracing impactful marketing tactics and executing them with precision.

These strategies are strategically crafted to sway consumers at various stages of the sales funnel, harnessing a multitude of elements that encompass user experience, high-quality content, and digital marketing tools.

Now, let’s delve into eight ingenious insurance marketing ideas aimed at expanding your reach to potential customers and successfully transforming them into loyal clients.

1. Prioritize Generating a Steady Stream of Favorable Insurer Reviews

In this modern digital age, individuals seeking a new insurance provider predominantly rely on the Internet as their primary resource to compare various offerings and insurers.

Reviews left by past or present clients play a crucial role in their decision-making process, offering potential buyers invaluable insights into the service quality they can anticipate from a particular insurance company.

To leverage this powerful tool, insurance companies must proactively take steps to encourage positive reviews and secure high ratings online.

This doesn’t solely pertain to the company’s official website, where customers may suspect insurers of cherry-picking only the most favorable testimonials, but also encompasses platforms like Google, Facebook, Trustpilot, and other well-known review sites.

Now, let’s explore the types of reviews that wield influence over sales. What sets them apart is their ability to transcend a mere 5-star rating, delving into the reasons why the insurer either met or exceeded expectations and providing a detailed description of the customer experience.

This doesn’t solely pertain to the company’s official website, where customers may suspect insurers of cherry-picking only the most favorable testimonials, but also encompasses platforms like Google, Facebook, Trustpilot, and other well-known review sites.

Now, let’s explore the types of reviews that wield influence over sales. What sets them apart is their ability to transcend a mere 5-star rating, delving into the reasons why the insurer either met or exceeded expectations and providing a detailed description of the customer experience.

For instance, a straightforward 5-star review with a brief comment such as “Great company” won’t carry nearly as much impact as five stars accompanied by a detailed account of clients’ seamless negotiation experiences with the insurer’s representatives, the array of options provided, and the top-notch responsiveness of the company’s customer support.

Authenticity is key when it comes to reviews, ensuring they emanate from individuals who genuinely tested the insurer’s offerings and genuinely appreciated the service received.

To showcase your positive reviews, contemplate integrating a Google review widget on your website.

2. Implement a Customer Referral Program

An additional potent method to expand your customer base and enhance sales involves establishing a customer referral program. These programs motivate existing customers to refer their friends and relatives by providing enticing incentives like discounts, freebies, or other rewards.

An excellent example of how referral programs can be effectively utilized to boost sales is demonstrated by Ethos Life, a life insurance provider.

Ethos Life introduced a referral program where customers were encouraged to refer their friends and family to purchase life insurance through the company. For each successful referral, they were rewarded with a $50 Amazon gift card.

The program’s success can be attributed to its simplicity and clarity, ensuring a seamless experience for participants. The FAQ section provided detailed answers that eliminated any confusion or uncertainty for potential participants. As a result, the program proved to be incredibly successful, leading to a significant increase in sales and fostering greater customer loyalty.

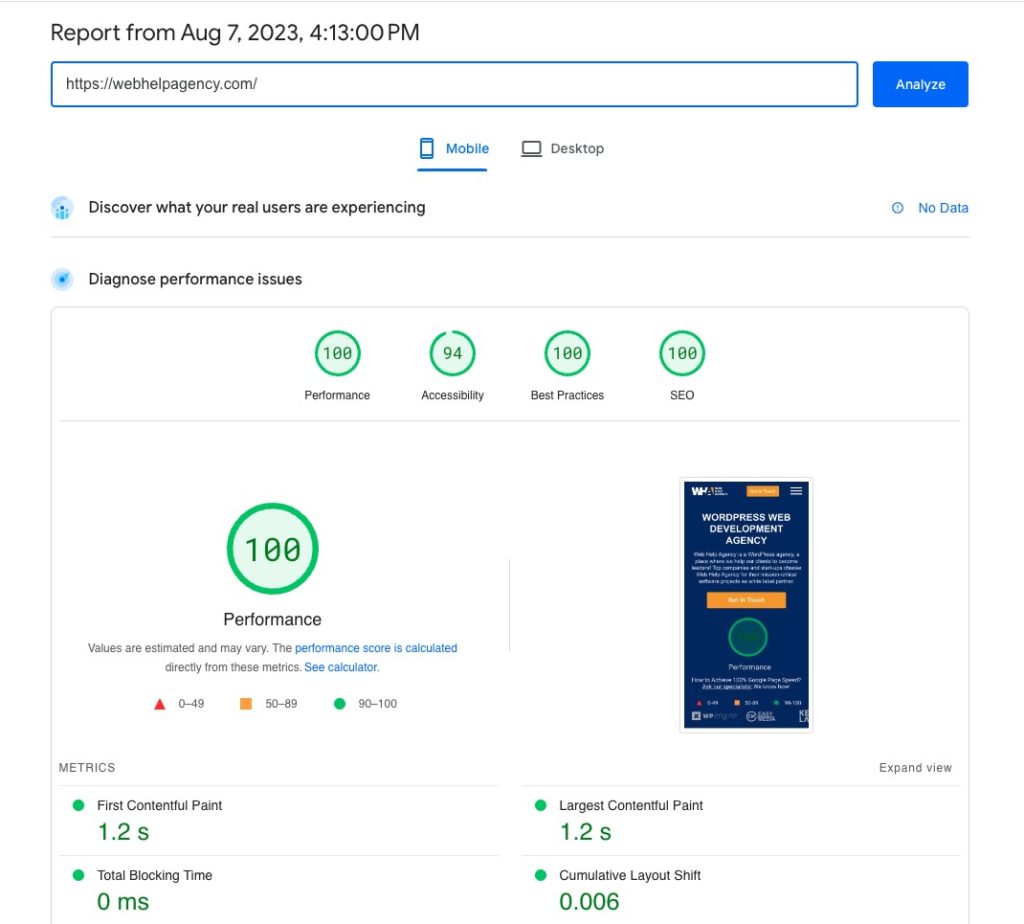

3. Prioritize High Speed and Seamless Navigation

As previously mentioned, prospective customers heavily rely on the internet to compare various insurance providers and make informed decisions about their next choice.

So, it’s imperative to ensure your website is fast, user-friendly and offers seamless navigation. Whenever a visitor faces obstacles while browsing your site, the likelihood of completing a purchase diminishes.

According to HubSpot, website conversion rates experience an average drop of 4.42% with every additional second of load time between seconds one and five.

Furthermore, it has been reported that 7 out of 10 customers acknowledge that page speed significantly influences their inclination to purchase goods or services from an online vendor.

Additionally, half of the individuals surveyed expressed their willingness to forgo animation and video content in exchange for a faster loading time.

When all other factors are held constant, a simple and fast-loading website proves to be more effective in converting visitors into clients compared to a flashy site with extravagant visuals that take too long to load. It’s crucial to bear this in mind during the website development stage.

Furthermore, according to a study by Think with Google, as page load time extends from 1 second to 3 seconds, the likelihood of bounce increases by 32%.

4. Seek Feedback Through User Testing Platforms

An exceptionally effective method to gather feedback on your website’s overall user experience or specific features, like an online quote calculator, is by utilizing user testing platforms such as UserTesting.com or Validately.

These platforms enable you to directly inquire from real users about their experiences with your website or online quote calculator.

The feedback collected from these interactions can be invaluable in making necessary adjustments and enhancements to your website’s user interface, navigation, flow, and overall design, ensuring an optimized user experience.

One prevalent method is usability testing, a type of UX research that evaluates the efficiency and user-friendliness of an electronic interface, web page, or e-commerce store, allowing users to accomplish their desired objectives seamlessly.

For instance, suppose you aim to assess how easily potential clients can obtain an insurance website quote online.

With the aid of these platforms, you can instruct the test taker to explore your website and request a quote while vocalizing any thoughts or critiques they may have about the process.

The platform will duly record the test taker’s screen activity and their verbal feedback. Accumulating this valuable information empowers you to obtain precious insights that can be leveraged to enhance the overall customer experience.

User testing platforms offer additional capabilities, including the ability to conduct surveys among individuals interested in purchasing a new insurance policy. Moreover, A/B testing enables you to gauge customer responses to different design elements, such as registration forms and calls to action.

Lastly, focus groups bring together diverse participants to engage in discussions related to the product or service being tested. This approach offers valuable insights into the motivations and behaviors of specific target groups, helping you gain a deeper understanding of your audience.

5. Build a Robust Content Marketing Strategy

A powerful approach to generating online leads is through the implementation of a well-crafted content marketing ideas strategy. This entails consistently publishing informative content that resonates with your target audience.

An excellent example is incorporating a blog or resources section on your website, offering valuable advice and tips on various topics, such as the advantages of purchasing life insurance or the different types of automobile insurance coverage.

To stand out from the competition, it is crucial to publish authentic content that provides genuine value not presently offered by other companies.

In today’s digital landscape, the internet is flooded with blogs, articles, and tutorials that often reiterate the same information using various words and styles.

To make a lasting impact, your objective should be to provide potential buyers with a distinct perspective, enabling them to broaden their understanding and make more informed evaluations of different offerings.

For example, if there are currently no comprehensive articles catering to potential life insurance buyers in a specific state or county, you could take the initiative to publish one that offers personalized advice to residents in that particular area.

Additionally, consider establishing a YouTube channel featuring tutorials and other valuable insurance-related content to attract a broader audience. Simultaneously, develop a robust social media marketing ideas strategy to drive traffic to your content.

Emphasizing content marketing ideas proves highly effective in building trust. Insurance companies should perceive themselves not merely as service providers but also as educational resources, offering valuable insights in their field.

When making the critical decision of selecting an insurance provider, potential clients extensively browse the internet, seeking valuable information to gain a deeper understanding of insurance policies and determine the best option for their individual circumstances.

By consistently encountering valuable and freely available content published on your website, social media, and other channels, they will perceive your company as an authoritative and trustworthy source in the insurance field.

As a result, this heightened trust and authority will significantly boost the likelihood of them selecting your company over other insurance providers when it comes to making their final purchasing decision.

6. Emphasize On-Page and Off-Page SEO

Ensure to give equal attention to both on-page and off-page SEO, targeting keywords that prospective insurers commonly search for.

While managing a paid advertising strategy with digital marketing tools demands an upfront budget for immediate results, SEO is a long-term approach that requires dedication and patience. However, when executed correctly, it can yield significantly better and sustainable outcomes.

On-page SEO revolves around optimizing your website’s page content and code, making it more favorable for search engines like Google to rank your page higher in search results.

Pumpkin, a pet insurance company, effectively employs this strategy by consistently creating and updating blog articles while also establishing authority for these posts.

Suppose you are striving to establish a presence in the Californian market. The keyword “life insurance in California” is likely to have a substantial number of searches, but it will also face intense competition.

On the other hand, the keyword “life insurance in Camarillo” might have minimal competition but, at the same time, a considerably lower number of monthly searches.

Nonetheless, through careful analysis of keywords such as “best life insurance in Ventura County” or “cheap life insurance in Riverside County,” you may eventually discover a keyword that is frequently searched by many people while being relatively unexploited by competitors.

Off-page SEO, on the other hand, encompasses link building and various external activities aimed at enhancing your website’s rankings on search engine results pages (SERPs).

Frequent off-page SEO techniques encompass guest blogging, content sharing via social media, and collaborations with influencers and press releases.

When devising your off-page SEO strategy, focus on securing content linking to your website on high-authority platforms. Domain authority is a measure of a website’s quality and credibility.

Including your links on a small insurance blog that has only been established for a few months and attracts merely 1,000 visitors per month won’t significantly improve your rankings.

On the other hand, when your backlinks are featured on multiple high-authority websites, your search engine rankings will experience a noticeable improvement.

It’s not mandatory for all these backlinks to come from insurance-related websites. Some backlinks may also originate from magazines and general financial blogs that have a long-standing presence and attract several thousand visitors each month.

For more details, you can explore the SEO roadmap.

7. Craft Compelling Lead Magnets

Lead magnets serve as enticements to attract potential customers and capture their contact information. Some examples of lead magnets include free eBooks, white papers, newsletters, discounts, and coupon codes.

Insurance companies can effectively utilize lead magnets by offering valuable resources like a free eBook on automotive safety tips or a comprehensive guide to selecting the best health insurance plan for individual needs.

When crafting a lead magnet, it’s crucial to ensure its relevance and appropriateness for your target audience, providing genuine value to them. Be sure to include a clear call-to-action and a form for potential customers to complete and receive the magnet.

8. Cultivate Collaborative Partnerships

Insurance companies can discover fresh prospects and elevate sales by forging partnerships with businesses that serve their target market. Through co-marketing strategies, insurers can leverage the customer base of these partner companies, effectively boosting brand awareness.

As an illustration, a health insurance company could collaborate with a fitness center to extend gym membership discounts to its policyholders.

This partnership would prove mutually advantageous, with the fitness center witnessing a rise in membership, while the insurer gains access to potential customers who are already interested in health and wellness.

Another instance involves an auto insurance company collaborating with a car dealership. In this scenario, the dealership could provide discounted rates on car purchases to policyholders, while the insurer offers enticing incentives like free roadside assistance or accident forgiveness coverage.

Such partnerships enable insurers to tap into new audiences and establish relationships with potential customers even before they acquire a policy. Moreover, they allow insurers to showcase their dedication to delivering value beyond traditional insurance coverage.

In Conclusion

Insurance companies must adopt proactive and innovative marketing approaches to distinguish themselves in today’s fiercely competitive marketplace.

Thankfully, there are numerous strategies that can assist insurers in enhancing visibility, attracting prospects, and converting them into loyal customers.

By concentrating on the appropriate marketing tools and tactics, which encompass SEO, social media, lead magnets, and partnerships, your company can adeptly attract new clients while effectively retaining existing ones.